NCERT Economics Class 10 | Loan Activities of Banks Notes

Topic & sub-topics covered: Loan Activities of Banks: Money and Credit (All single detail notes are exam-oriented).

We have discussed in-depth and exam-oriented pointers that can be asked in the board exam of class 10th about “Loan Activities of Banks” which is taken from the NCERT Economics notes for class 10th chapter 3 “Money and Credit“.

Download the NCERT Economics for Class 10th Chapter 3 Money and Credit Notes PDF

Looking to grasp the concepts of money and credit in NCERT Economics for Class 10th? Look no further! Download the comprehensive Chapter 3 Money and Credit Notes PDF now and unlock a treasure trove of knowledge.

NCERT Class 10 Economics Chapter 3 Money and Credit Class 10th PDF Notes

Delve into the intricacies of monetary systems, explore the role of credit in the economy, and understand the mechanisms of banking and financial institutions. Our meticulously prepared notes provide concise explanations, illustrative examples, and insightful analysis to deepen your understanding of this crucial subject. With a clear focus on exam preparation and academic excellence, our PDF notes offer a structured approach to learning, helping you grasp complex concepts with ease.

Gain confidence in your knowledge and ace your exams with the help of our top-quality study material. Don’t miss out on this opportunity to elevate your learning experience – download the NCERT Economics for Class 10th Chapter 3 Money and Credit Notes PDF today!

Loan Activities of Banks

1. Utilization of Deposits:

- Banks use deposits from the public for various purposes.

2. Cash Reserves:

- Banks keep only a small fraction of deposits as cash reserves, typically around 15% in India.

3. Purpose of Cash Reserves:

- Cash reserves are maintained to meet the withdrawal demands of depositors.

4. Loan Extension:

- The majority of deposits are used by banks to extend loans to borrowers.

5. Loan Demand:

- There is a significant demand for loans for various economic activities.

6. Role of Banks:

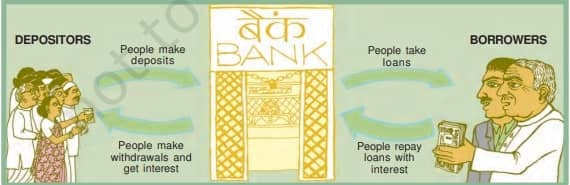

- Banks act as intermediaries, connecting depositors with surplus funds to borrowers in need.

7. Interest Rate Differential:

- Banks charge a higher interest rate on loans compared to the interest rate they offer on deposits.

8. Income Source for Banks:

- The difference between the interest earned on loans and the interest paid to depositors forms the main source of income for banks.

Next & Previous Topics of NCERT/CBSE Economics Class 10 Chapter 3: Money and Credit

FAQ

Q1. Explain any three loan activities of banks in India

In India, banks engage in various loan activities to support economic growth and meet the financial needs of individuals and businesses.

Here are three common loan activities conducted by banks:

- Retail Loans: Retail loans are offered by banks to individual customers for personal purposes such as purchasing a home (home loans), buying a vehicle (car loans), funding education (education loans), or meeting other personal expenses (personal loans). These loans typically have fixed or floating interest rates and are repaid in equated monthly instalments (EMIs) over a specified period. Banks assess the creditworthiness of applicants based on factors such as income, employment status, credit history, and collateral (if required). Retail loans contribute significantly to consumer spending and asset acquisition, thereby stimulating economic activity.

- Corporate Loans: Banks extend credit to corporations and businesses to finance their operations, expansion, working capital requirements, and capital expenditure projects. Corporate loans can take various forms, including term loans, overdraft facilities, cash credit arrangements, and trade finance solutions. These loans are tailored to meet the specific needs of businesses across diverse sectors such as manufacturing, infrastructure, services, and agriculture. Banks evaluate the creditworthiness of corporate borrowers based on factors such as financial performance, industry outlook, collateral (if applicable), and the purpose of the loan. Corporate loans play a crucial role in fueling business growth, supporting entrepreneurship, and driving economic development.

- Agricultural Loans: Agricultural loans are provided by banks to farmers and agricultural enterprises to meet their production, investment, and consumption requirements. These loans aim to enhance agricultural productivity, promote rural development, and alleviate rural poverty. Agricultural loans may include crop loans, term loans for farm machinery and equipment, livestock loans, and agri-business loans. Banks often collaborate with government agencies and rural development institutions to extend credit to farmers at subsidized interest rates and offer flexible repayment terms. Agricultural loans are essential for sustaining food security, enhancing farm incomes, and fostering inclusive growth in rural areas.

These loan activities demonstrate the pivotal role of banks in facilitating financial intermediation, channelling funds from savers to borrowers, and supporting diverse economic activities in India.

Q2.What is the purpose of maintaining cash reserves in banks?

Answer: Cash reserves are maintained to meet the withdrawal demands of depositors.

Q3. What constitutes the main source of income for banks, according to the paragraph?

Answer: The difference between the interest earned on loans and the interest paid to depositors forms the main source of income for banks.